With the first phase of the EU’s Sustainable Finance Disclosure Regulation having gone into effect, it’s clear significant changes are coming to the investment sector. But although it may weed out the greenwashers, it could also make things even more confusing.

The struggle to provide investors and other stakeholders with better data on the sustainability and impact of companies is today’s greatest market inefficiency. Gathering and assessing that data, however, is not a simple task; nor is making sure it is comparable, consistent, and actionable.

For instance, the recent Boohoo scandal has put the ESG data market under sharp scrutiny and although there are a plethora of data providers, there is little agreement between them: correlations average a meagre 0.54. If data providers disagree on the criteria, scope, and relative weight of ESG considerations, how can investors know their investments are truly sustainable?

Winners and losers

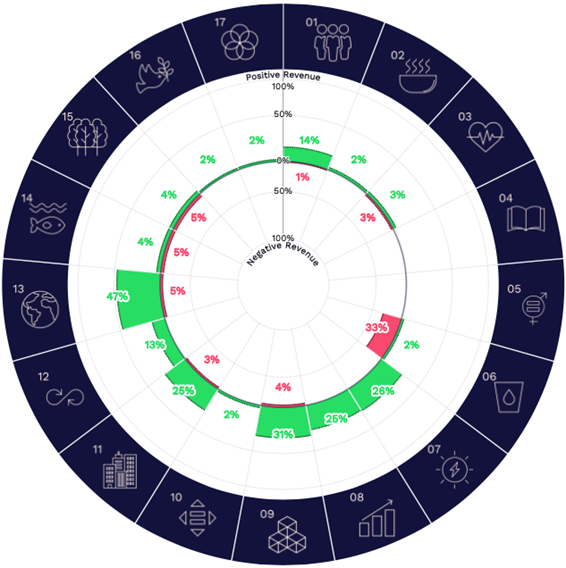

In order to answer the question of which sectors have become more sustainable over the past five years we have used our data sets to assess whether what a company sells makes the world better, or worse. This is done by looking at how they are making money and how that aligns (positively or negatively) with the UN Sustainable Developments Goals (SDGs). A metric for this is “% revenue alignment,” which can be mapped for over products and sustainability concepts, including the 17 UN SDGs. The chart below is an example of a typical company’s positive and negative % revenue alignment to each of the 17 SDGs.

This “% alignment” metric helps to answer key questions like those above, but raises another: how do investors decide between large companies doing a little good, and little companies doing a lot of good? For this reason one can calculate a ‘USD revenue alignment’ as well.

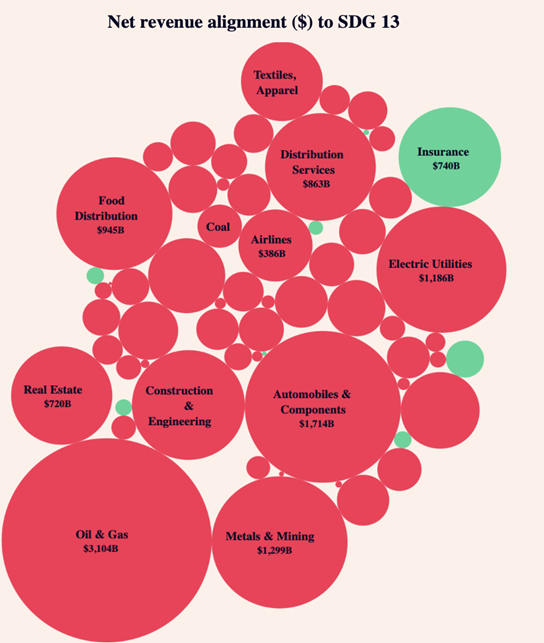

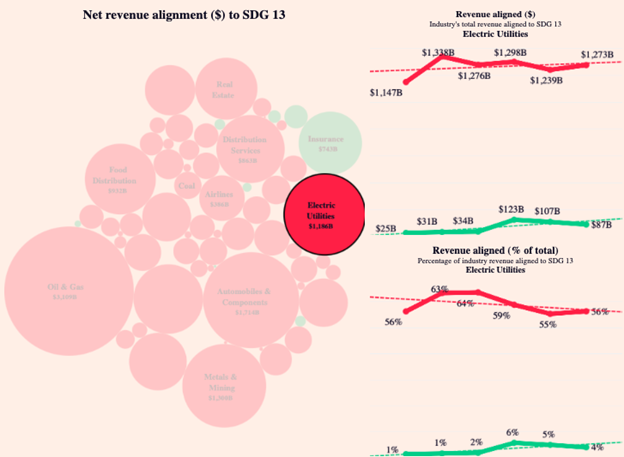

The key takeaway is that there is no simple answer. First, the bad news: let’s take climate change, an example many of us would think of immediately. We’ve known about it a long time, and it’s been a key issue for companies and governments for many years. Below is a chart showing the net revenue alignment to SDG 13 (climate action) for all the industries we cover.

The abundant red circles are industries whose revenues have a negative impact on SDG 13, climate action. So, for all that we may be aware of this critical, existential issue, there are still vast amounts of money flowing from products that are making it worse, and not much from those making it better.

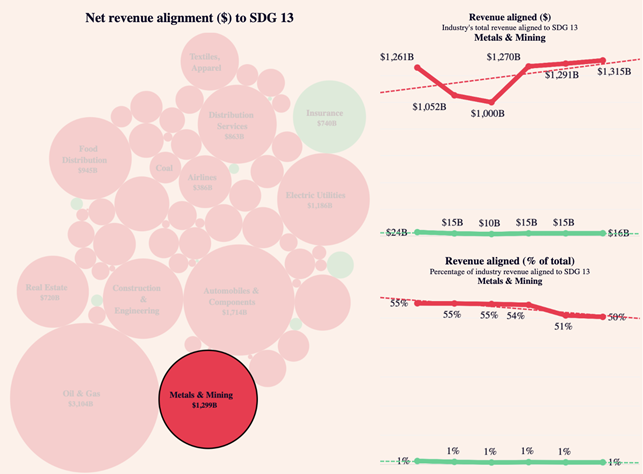

It is also true, however, that some industries are decreasing their dependence on these negative sources of revenue. But if anything, that just reveals the scale of the problem: for example, oil and gas, and metals and mining are actually generating revenues in slightly less harmful ways (see chart below on the bottom right, “% revenue alignment” for metals and mining), but the flat green lines show they are not increasing any positive impact. And because the industry has grown in recent years, generating more revenues from products that are still harmful, the overall negative impact has also grown (this is the chart on the top right, “$ revenue aligned”).

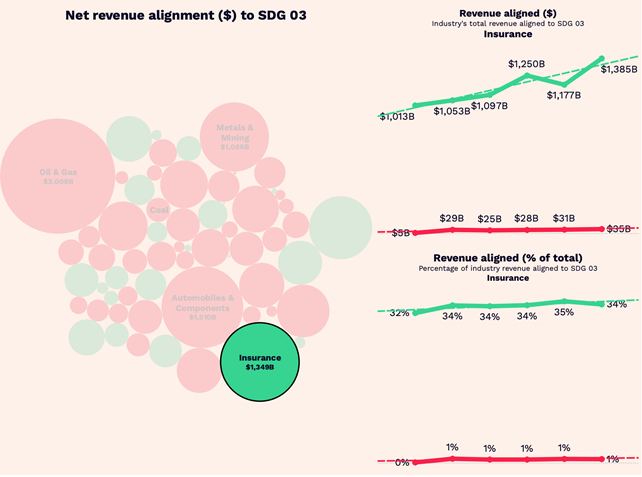

There is some good news, though. There are other industries for which the opposite is true. Insurance, for instance, has slightly improved in its positive alignment for good health and well-being (SDG 3), and has also grown as an industry, so its positive impact on good health and well-being has increased significantly.

The second largest for improving impact is tech-related (software and services), not only a growing industry segment, but also tech is increasingly important in a variety of “healthy” ways, like early warning systems, preventive care, treating substance abuse and mental illness, to take just a few quick examples.

Another improving area is the alignment of electric utilities on climate action (SDG 13): net revenue alignment is still negative, but the negative % alignment is decreasing (bottom right of the chart below), and the growth in positive $ revenues is faster than the negative ones (top right).

Our analysis raises two important points. First, this is why the depth of data matters: tempting as it may be simply to rank or rate companies relative to one another, critical information for investors is lost in the process. If a tobacco company gets the same good ESG rating from one year to the next, but grows its revenues by almost 35% from products that literally cause the highest number of preventable deaths in the world, shouldn’t that matter? Should its good rating remain the same this year when it is making more money from a harmful product? The answer may seem obvious, but is not currently captured by commonly used datasets.

Second, the data itself also helps us understand a good deal more about what we actually need to do. It’s not enough to make products a little more sustainable, or a little less harmful. Companies (and industries) need to make these improved products central to their business so that growth translates into more positive impact. Today’s success stories in renewable energy, for instance, are dwarfed by the growing demand for fossil fuels. This is the paradigm that needs to be reversed.

Clearly, that’s a tall order. But the only way to get there is to source large amounts of timely, trustworthy data, thoughtfully letting technology help us get it, and face what that information can tell us. Bad news, sadly, often comes in the form of good data.