Institutional investors, including Local Government Pension Scheme (LGPS) funds, rarely analyse their investments using a place-based lens. They routinely allocate capital across the global markets without questioning whether allocations closer to home might deliver comparable returns and diversification while benefiting the development needs of members’ communities.

But research shows this type of place-based investing even offers superior performance along with local impact. Last month The Good Economy published a white paper, Scaling-Up Institutional Investment for Place-based Impact, in partnership with the Impact Investing Institute and Pensions for Purpose. It builds a compelling case for pension funds to invest in sectors that would drive local economic growth and development – helping tackle long-standing place-based inequalities – as well as delivering appropriate financial returns.

See also: – Calls for pension schemes to invest more locally

Our focus was on the £326bn LGPS and the role of its member pension funds in scaling up this type of investment activity. But this is an opportunity for all institutional investors to ‘walk the talk’ when it comes to their growing interest in the social component of ESG and contributing towards the Sustainable Development Goals (SDGs).

It would also be a way for private capital to play a role in building back better and the levelling up agenda, alongside public investment.

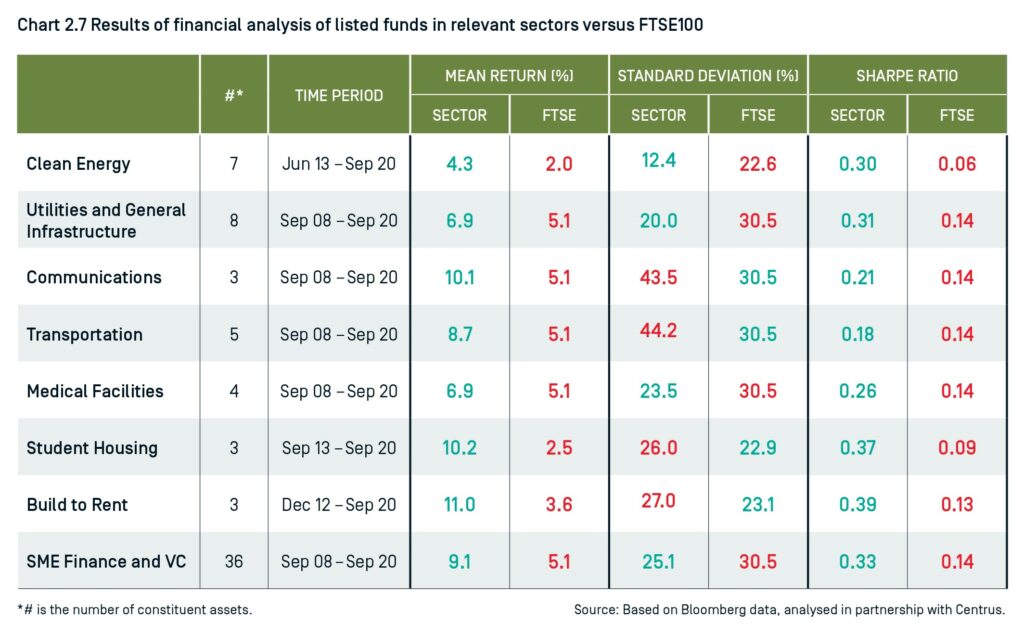

The long-touted argument against this kind of strategy is that it faces pension funds with fiduciary conflicts, higher fees, greater complexity and higher risk with no guarantee of higher returns. However, our research demonstrates investing in key sectors – that could drive building back better – can deliver risk-adjusted returns that are clearly in line with institutional investor requirements.

There are sound investment opportunities in clean energy and infrastructure sectors, and growing opportunities to invest in social and affordable housing, small and medium-sized enterprises (including private debt and private equity funds) and urban regeneration funds.

There has been a significant growth in the number of funds on offer: over the past three years the number of private markets funds has increased by 16% and listed funds have more than doubled in number. We identified 176 listed and unlisted funds managed by 127 fund managers.

Our analysis demonstrated that the funds’ risk-adjusted returns were highly attractive delivering 1.5 to 2 times returns on the FTSE100 with less variability. Far from inhibiting returns, these investments are more attractive than mainstream assets. Furthermore, many are cashflow generative and countercyclical, providing portfolio diversification benefits for pension funds.

Three steps for change

I suggest three fundamental steps for change. The first is for pension fund investment committees to put this topic on the agenda. We identify five characteristics that define place-based impact investment (PBII). A critical feature is that these investments support sustainable development needs and priorities as identified by local stakeholders.

The second is for pension funds to ask their consultants to research these opportunities. Currently, there is a vicious cycle in which specialist funds are not recommended by consultants on the premise there isn’t sufficient widespread client demand. So these fund struggle to raise capital at scale and then remain too small to be considered by pension funds.

Finally, the views of pension scheme members should be recognised. We know the vast majority of people have little idea as to how their pension pots are invested. But we also know from research undertaken for the UK government department for international development by PwC and The Good Economy that 70% of the public would like their money to have a positive impact in the world.