The top 20 largest ESG equity funds vary largely by approach, age and domicile, according to research from MSCI, but are largely focused on the technology sector and are in the active space.

In analysis entitled Top 20 Largest ESG Funds – Under the Hood carried out by senior associate for MSCI Research, Rumi Mahmood, it was found there are many differing factors including objectives, methodologies and geographic exposures despite concerns in the investment industry of greenwashing and the launches of ‘me-too’ products.

He commented: “The ESG fund universe is anything but uniform. The largest of these funds very much reflect the spectrum of investors’ choice and preferences, active and index-based approaches, degree of ESG integration and screens based on values and thematics.

“They highlight the fact that there is no one way to invest sustainably, as well as demonstrate clearly that different investors may be at different stages in their ESG journey and that their preferences can be quite diverse. A solid understanding of fund ESG policies can be essential in helping investors make the most of their fund decisions.”

Mahmood, who previously worked at Nutmeg, added the lion’s share of the top 20 funds were in the active management space, but noted that for flows in 2020 much of this went into index products.

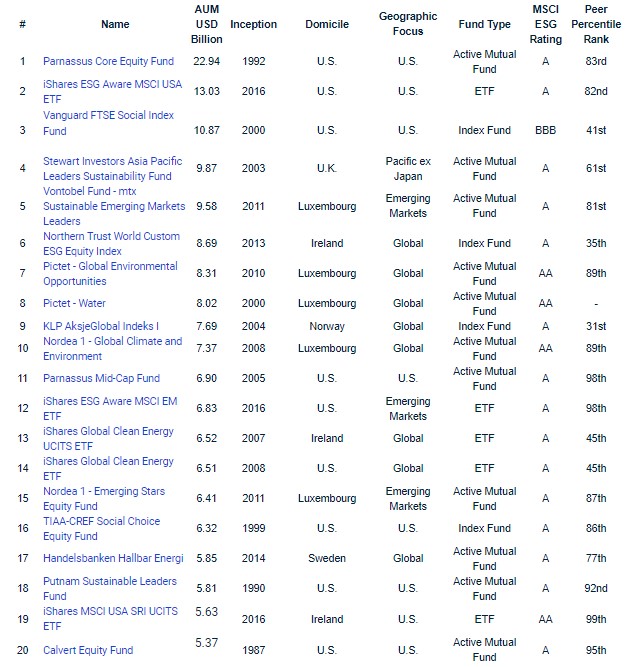

How the 20 largest ESG equity funds break down

Information technology was the largest allocation in most funds, with an almost zero allocation to energy (see exhibit below). This sector-based exposure was one of the key drivers behind the recent short-term outperformance of many ESG funds relative to their non-ESG counterparts, as tech stocks rallied in 2020 while energy declined.

The research analysed the top 20 largest funds in the global ESG fund universe, as defined by MSCI, as at 31 December 2020. In total, these funds held $150bn in assets combined, representing 13% of the total assets sitting globally in ESG equity funds.

Mahmood noted the funds varied widely tenure and domicile, while the oldest fund is more than 30 years old and the youngest just over five.

More than half were domiciled in Europe, but most funds invested in US equities. This, Mahmood said, is likely down to the funds’ high exposure to the information technology sector – it was the largest allocation.

Google parent Alphabet was the most commonly held stock with an average weight of 1.9% across 12 of the funds. Other popular tech stocks included Apple, Applied Materials and Cadence Design Systems and Microsoft.

“This sector-based exposure [to technology] was one of the key drivers behind the recent short-term outperformance of many ESG funds relative to their non-ESG counterparts, as tech stocks rallied in 2020 while energy declined,” Mahmood said.

He also told ESG Clarity that this is a reflection of tech’s market capitalisation in the wider listed market and therefore he did not have concerns around ESG fund concentration in this area.

Other popular holdings were Ecolab and Thermo Fisher Scientific.

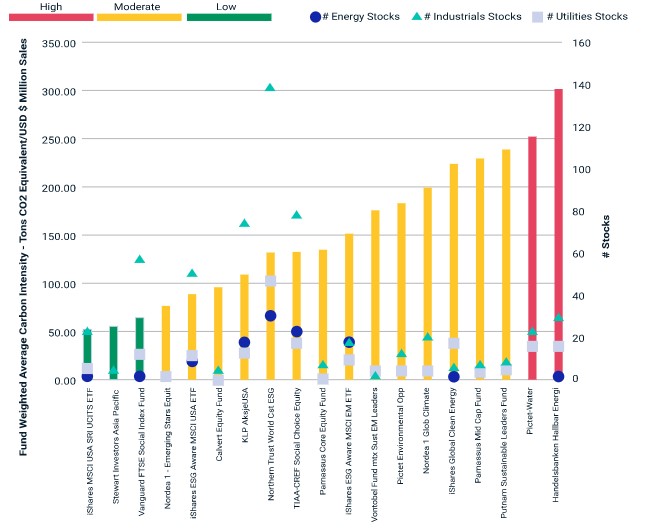

Carbon intensity

The research also looked at the carbon intensity of the 20 biggest funds and found that while exposure to the energy sector was largely absent from group, it did feature in some index-based funds and these tended to have a lower carbon intensity than those with zero energy exposure.

Mahmood explained: “Among the funds in our analysis that did not hold any energy stocks, most were actively managed; meanwhile, most that did hold energy were index-based funds. But how does that reconcile with real-world carbon emissions? The energy sector tends to score poorly on environmental issues, meaning that funds with energy exposure might have heightened exposure to pollutive companies or higher carbon intensity. Holdings alone do not provide the full picture, however; in fact, there were funds that did not have any energy stocks but exhibited a substantially higher carbon intensity than those that did.”

Funds’ weighted-average carbon intensity vs. holdings

Summarising, he added: “A lot of fund groups have similar ESG policies but very different exposures and inherently different mandates. Investors need to be mindful of this when selecting ESG funds.”