Changing consumer habits, inclusivity, biodiversity and the path to net-zero were the key topics covered at the first discussion of the Global ESG Summit, with panellists pointing out these were key in the demand for ESG products.

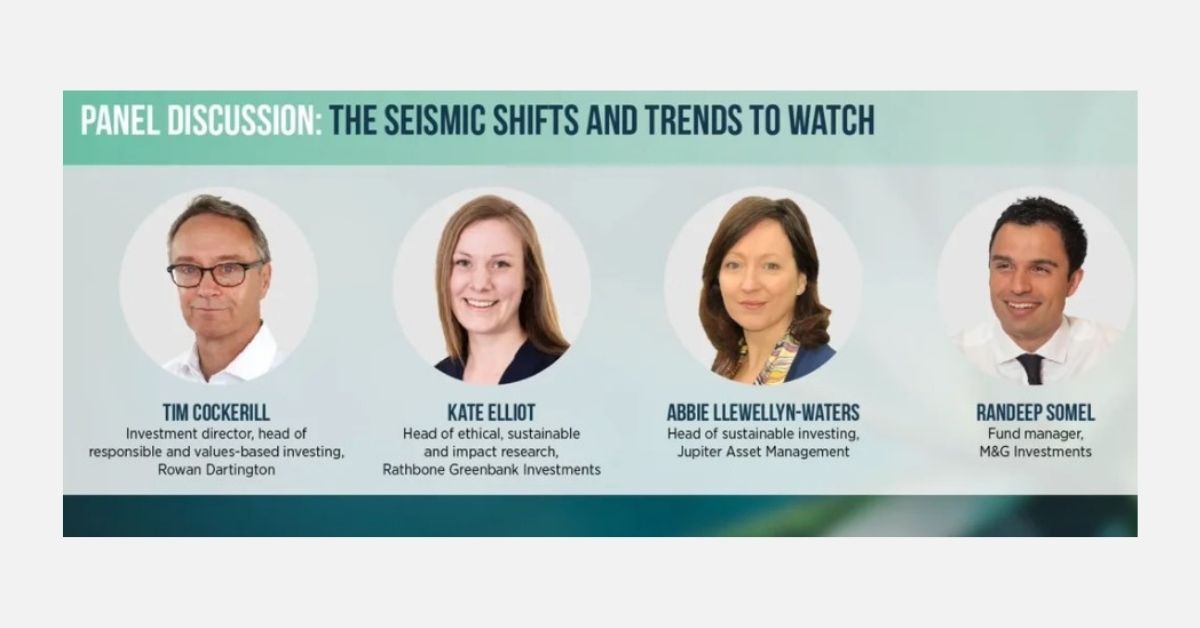

The session, titled The seismic shifts and trends to watch and moderated by Last Word Media’s global head of ESG insight Natalie Kenway, explored how fund managers and fund selectors had interpreted the key factors driving interest in responsible investing and explain how they integrated this into investment decisions.

Panellists included:

Tim Cockerill, investment director, head of responsible and values-based investing, Rowan Dartington

Kate Elliot, head of ethical, sustainable and impact research, Rathbone Greenbank Investments

Abbie Llewellyn-Waters, head of sustainable investing, Jupiter Asset Management

Randeep Somel, fund manager, M&G Investments

The full video can be watched here.

Climate change and the consumer

In terms of consumer trends, the panellists said shoppers are much more conscious of the products they are buying in terms of the carbon output, and they want to do “their bit” in terms of mitigating climate change.

Somel explained: “Consumer brands are getting more and more into this frame. They realise they need to change the way they source and manufacture products, and then we also have newer brands coming in.”

He referenced the recent IPO of Oatley, which produces plant-based milk. The Swedish company listed on the New York Stock Exchange with a $11bn market cap and had celebrity backing from the likes of Oprah Winfrey and Jay-Z.

“Consumers are moving more towards brands like this as they understand the environmental and health benefits of what they are doing,” the M&G manager said.

Cockerill also highlighted the popularity of veganism is increasing amid the growing awareness of agriculture being a huge contributor to greenhouse gas emissions, but also “that people feel empowered by doing something”.

Jupiter’s Llewellyn-Waters agreed there is an “unprecedented rate of change” in terms of public awareness, particularly as the physical effects of climate change have become more acute in recent years – she pointed to the Australian bush fires and severe droughts in Taiwan and Latin America as examples.

“There is clear understanding that our savings can genuinely contribute to addressing these broad stakeholder issues. There is also an understanding of a company’s relationship with the planet either through their product or their behaviour, and ultimately understanding that this is their social licence to operate. How companies consider these long-terms risks will be absolutely critical in considering investment opportunities.”

See also: – Jupiter’s Llewellyn-Waters: Achieving a net-zero economy is our fiduciary duty

Rathbone’s Elliot added this ‘social licence’ is a way for companies to gain “a competitive advantage over some of the other companies that maybe beaten purely on price”.

All the panellists said these factors were huge considerations for portfolios they were responsible for. “Companies need to not only show good at ESG but providing a net benefit for society and prove it,” Somel stated.

Diversity and corporate culture

The panellists were also asked their views on the correlation between economic sustainability and inclusivity, and how it is considered in their investment processes.

“Inclusion is a key focus when considering investment opportunities,” said Llewelyn-Waters.

While ESG Clarity has reported on the challenges surrounding diversity data, the Jupiter fund manager noted this is improving “particularly with regard to gender and race where there is greater availability of data to be included in fundamental analysis”.

Both managers, Somel and Llewellyn-Waters, said they looked beyond board and executive management representation for underlying operational approaches to inclusivity.

“We look at participation rates, the progressiveness of policies particularly in relation to parental leave, promotion rates and how is it supporting a more inclusive workforce,” Llewellyn-Waters said. “We are seeing better transparency and with that hopefully better representation.”

Somel added the impact team at M&G is looking at diversity from many levels, including religion and sexual orientation, and highlighted: “The best companies puts this data in their sustainability reports.”

He also explained the importance of understanding a company’s culture: “It is so important – it can make or break a company. But it is also one of the hardest things to ascertain as an outsider, it really is hidden in plain sight.”

The fund selectors on the panel said they had more queries from clients on how they can access investments that support inclusivity.

Cockerill said: “This is something that has come to the fore with clients over the past 12 months, we have had a lot more queries. We are asked if we can buy portfolios around women’s rights or workers’ rights, but the data is just not great.”

Biodiversity loss

Biodiversity has been a big topic for the investment management industry in recent months – in May ESG Clarity reported on industry progress in terms of measuring the loss of natural capital amid World Environment Day, World Bee Day and No Mow May. Furthermore, the Taskforce for Nature-related Financial Disclosures (TNFD) was launched in early June.

More than half of global GDP is reliant on natural capital, highlighted Llewellyn-Waters during the Global ESG Summit panel.

Cockerill continued: “We as a species are so dependent on the planet and biodiversity. It is so badly needed, biodiversity is the next big thing people need to focus on and we haven’t got a lot of time.”

Referring to an ESG Clarity column he authored, Cockerill said there is an “interconnected nature of everything”.

“People tend to look at things in silos, but climate change and loss of biodiversity are all connected. We hear people talking about deforestation and the loss of the Amazon, but you can see biodiversity loss in your own back garden. The industry needs to really come together and find a way to measure this.”

See the latest issue of ESG Clarity digital magazine – a biodiversity special

Rathbone’s Elliot said her company had signed the Partnership for Biodiversity Accounting Financials (PBAF), alongside many other investment managers to explore how investments, and financial institutions can play an important role in the conservation and sustainable use of biodiversity, contributing not only to the biodiversity targets of the Convention on Biological Diversity, but also to the reduction of investment risks.

“A single company can have a multitude of impacts, positive and negative, on different aspects of biodiversity, and trying to scale that to the portfolio level is incredibly complex.

“We are working with PBAF to help find consistent data points for investors to measure. Over the course of this year, we are trialling a biodiversity footprints across our investments at Rathbones. We are hoping that will help us identify particular hot spots.

“If we are able to get companies to change their behaviours and practices it will have the biggest amount of real-world impact.”

Path to net zero

The final element discussed by the panel was the transition to a net-zero economy in the lead-up to COP26 in Glasgow this November. There have been an increasing number of companies making net-zero commitments over various timeframes, but the panellists highlighted numerous ways investors can check whether these are concrete pledges or lip service.

Llewelyn-Waters commented: “There are different frameworks to follow to quantify the actionability of these plans and targets but ultimately, we want to see is a reduction in emissions – not offsetting.”

Somel and Elliot noted they are looking for alignment with science-based targets but also said interim targets are “absolutely key” given that many of these pledges are over the very long term.

Elliot explained: “The average board tenure is five to seven years and some of these net-zero targets are set out for 2050. Essentially, there is no accountability for that so want to see steps for 2025, 2030, etc but also that reductions are being made now rather than being pushed out into the future. We want a gradual transition not a disruptive one.”

Both also added these targets should be linked to executive pay.

“Setting longer targets are not very helpful,” Somel said. “There needs to be interim targets and remuneration needs to be linked to that. Science-based targets should be the norm now. It’s also a culture point of the business – how is it linked to pay, how is the information made available and then being held accountable to that data year in year out.”