The European Fund and Asset Management Association (EFAMA) has welcomed regulatory proposals to extend the EU Taxonomy so that it covers the “harmful activities” within businesses, highlighting it would accelerate the sustainable transition.

In a EU Platform on Sustainable Finance document released in July, which announced the Public Consultation on Taxonomy Extension Options Linked to Environmental Objectives, it said the European Commission had mandated the body to work on a possible extension to the Taxonomy, to include “activities significantly harmful to environmental sustainability and activities with no significant impact on environmental sustainability”.

It has been consulting with industry participants and plans to publish a report on the findings at the end of 2021 detailing provisions necessary to extend the scope of the Taxonomy Regulation beyond environmentally sustainable economic activities.

See also: – Will the EU Taxonomy become a toothless tiger?

The EU Taxonomy currently classifies economic activities that achieve performance levels making a “substantial contribution” to at least one of six environmental objectives. The activities must also ensure no significant harm is caused to any of the other five objectives and meet minimum safeguards in order to qualify.

The six environmental objectives covered by the Taxonomy are: climate change mitigation; climate change adaptation; the sustainable use and protection of water and marine resources; the transition to a circular economy; pollution prevention and control; and the protection and restoration of biodiversity and ecosystems.

It is proposed that an extension to include “activities significantly harmful to environmental sustainability” – sometimes known as ‘brown activities’ -will support the transition to a more sustainable economy.

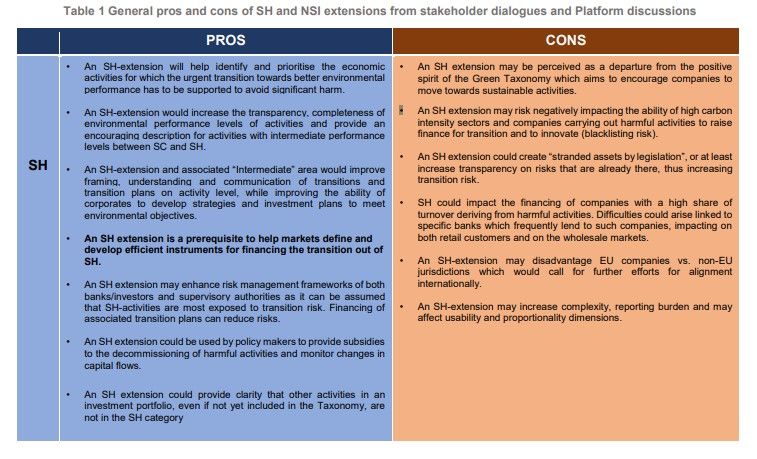

The EU Platform on Sustainable Finance paper outlined a number of pros and cons to extending the scope:

This week, EFAMA has responded to the consultation public and included five recommendations for the EU Platform on Sustainable Finance to consider.

These are:

Support companies in their transitioning away from significant harmful activities.

EFAMA said by distinguishing significantly harmful activities that have the potential to transform and no longer cause harm, asset managers will be able to design better, bigger and safer decarbonisation financial products.

“The enlarged taxonomy-aligned investible universe would decrease risks associated with the current environmental taxonomy, such as overweighting of highly green assets or the emergence of green asset bubbles. Investee companies would benefit from more clarity about which environmental performance levels are no longer acceptable, thereby improving the credibility of their decarbonisation plans.”

Avoid a blacklist-based approach to the extended Taxonomy.

EFAMA requested the EU Platform for Sustainable Finance avoids “blacklisting” activities as this will encourage divestment. “If investors are asked to stop investing in some companies this will disincentivise their existing transition efforts and ignore the benefits of engagement.

Moreover, a blacklist may not only lead to decommissioning of significantly harmful activities and companies, but also drive their selling to non-European or less climate-conscious investors, potentially below value, without any positive impact on climate,” the response said.

Develop Paris-aligned reference trajectories for every relevant sector to make firms’ emission reduction strategies credible, comparable and science-based.

EFAMA also proposed the Taxonomy extension should also act as a vehicle for introducing “quality standards and verification procedures to such forward-looking transition plans”.

Set up a Transition Asset Ratio.

This would sit alongside the existing Green Asset Ratio and reward companies entering the transition and incentivise their access to financing without misrepresenting transitioning activities as green.

Avoid focusing on a legally binding ‘no significant impact’ (NSI) taxonomy at this stage.

EFAMA highlighted this pointed given the marginal significance of such companies for the transition at a macro level. NSI activities could be covered in non-binding guidance, giving investors clarity on which activities are considered ‘not critical’ in terms of environmental impact, it said.

Commenting on the recommendations, Tanguy van de Werve (pictured), EFAMA director general, said: “An effective sustainable finance ecosystem should aim at rewarding companies with the best environmental performance, as well as attracting funding for companies with credible and ambitious transition plans. The proposal to extend the Taxonomy and include significantly harmful activities in urgent need of transition, would allow asset managers to bring to market financial products that help the ‘hard-to-decarbonise’ sectors confront climate change and accelerate their necessary transformation”.