Ecology funds were in great demand over the past 12 months, resulting in some of the strongest inflows across Morningstar categories. As market-cap exposure and portfolio concentration vary strongly across funds, investors should keep a close eye on funds’ maximum capacities. This is especially true as some of the funds saw their assets under management bloated.

For many years, ecology funds led a secluded life. Although global equity funds in nature, their strict focus on environmental-related businesses made them only of interest to investors who had a particularly strong commitment to sustainable investing.

However, sustainable investing has seen a significant increase in investor appetite across the board, and interest has particularly stood out with regard to ecology funds.

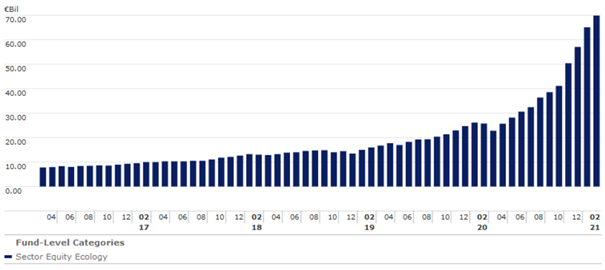

The aggregate level of assets under management for all ecology funds that are available for sale in Europe has been hovering around €10bn for years. Moreover, the growth in total assets was primarily the result of rising stock prices rather than inflows.

This changed somewhat in 2019 when the category saw total net inflows of €6.4bn, but with almost €25bn in inflows, the category saw an explosive growth in demand in 2020. This trend has continued in early 2021. Over the first two months of the year, ecology funds had already attracted almost €12bn.

At the end of 2018, ecology funds managed €13.5bn in total assets, and driven by strong inflows over the two years that followed, total assets surged to €70bn at the end of February 2021.

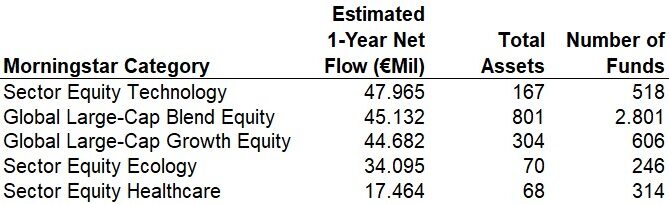

Over the trailing 12-month period, the sector equity ecology Morningstar category was the fourth popular category in terms of flows. Funds gathered €34bn, or just €10bn less than category behemoth global large-cap blend, which houses more than 10 times the number of funds.

Although the rise in assets has been spectacular, it could also become a point of concern for investors because funds might have to cope with the handicap of asset bloat. If funds get too large and are not closed in time, the larger asset base might impact the alpha-generation capabilities of the strategy.

An increasing number of portfolio holdings, lower-conviction ideas appearing in the portfolio, or a move up the market-cap ladder are indications that the manager is struggling to manage the larger asset base.

This is especially important in categories such as the sector equity ecology category, which consists of funds that invest in a very wide range of market caps. To illustrate, funds with a focus on the lower end of the market-cap spectrum invest in companies that have an average market cap of only several billion euros. These can be labelled as small-cap strategies, but on the other hand, there are also numerous strategies that focus on the large caps and mega-caps and show average market caps of more than €80bn.

Impax and Pictet soft-close funds

In recent months, several strategies have closed their doors to new investors, with existing shareholders provided with limited room to add to new money. Two funds covered by Morningstar analysts are among this group of funds.

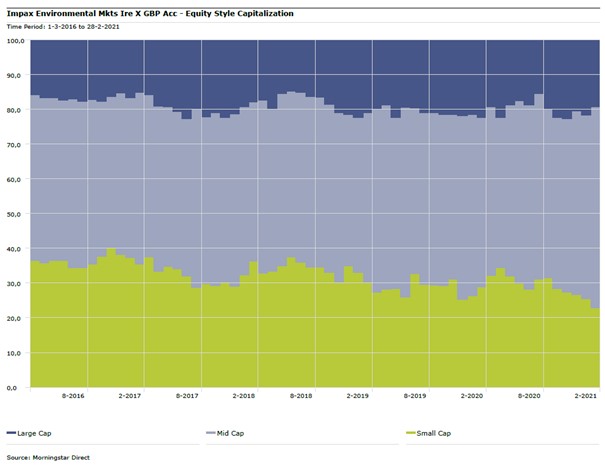

Impax Environmental Markets (Ireland) Fund, which has a Morningstar Analyst Rating of Silver, was one of the first funds to soft-close in July 2020. As assets under management grew for this strategy, we haven’t seen any changes in the characteristics of the portfolio.

Typically, it invests around 80% of assets in mid caps and small caps or about double the average allocation for category peers. While the portfolio has shifted somewhat towards mid caps, that has been driven more by market movements than by the managers actively changing the portfolio’s market-cap profile. At the same time, the portfolio’s concentration was unchanged, with roughly 60-65 holdings and around 25% of assets invested in the 10 largest holdings.

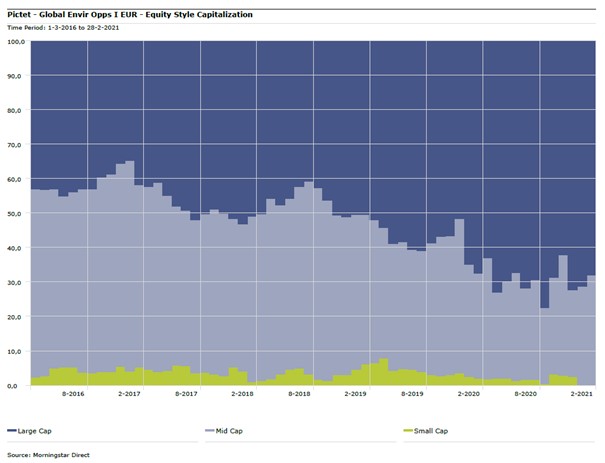

More recently, as of 15 March 2021, Pictet – Global Environmental Opportunities, which is rated Bronze, joined the growing number of soft-closed funds. Over a trailing one-year period up to the end of February 2021, the Pictet strategy saw almost €4bn of net inflows, lifting the total assets under management to slightly above €7.5bn. This makes it one of the largest strategies within the sector equity ecology Morningstar category.

See also: – Pictet closes global environment fund

The portfolio is tilted more towards large caps relative to peers as it invests around 65% of its assets in the larger-cap segment, while peers average around 55%. Again, concentration metrics haven’t changed here as well. Top 10 concentration moved within the 30% to 35% range, and the number of holdings hovered around 50 stocks.